Amazon Pay India posts another quiet year as revenue dips by 9%

Amazon Pay India reported another year of stagnant performance in FY25, with revenue slipping 9% to Rs 2,096 crore and net losses narrowing only marginally to Rs 865 crore

• Amazon Pay India reported another year of stagnant performance in FY25, with revenue slipping 9% to Rs 2,096 crore and net losses narrowing only marginally to Rs 865 crore, a pattern reflecting a flat trajectory over the past three years.

• While the company managed to trim total expenses to Rs 3,060 crore, primarily through reduced payment processing and employee costs, advertising expenses still rose slightly, remaining the largest single cost item at over 50% of the total outgo.

• Despite various initiatives, including EMI offers and expansion into bill payments and ticketing, Amazon Pay’s growth lagged as it struggled to break out beyond its core ecommerce-linked user base, averaging a spend of Rs 1.46 for every rupee earned.

• This plateau contrasts sharply with the fierce growth dynamics at larger payments companies, such as PhonePe (owned by Amazon rival Walmart) and Paytm. For FY25, PhonePe’s revenue jumped 40% to Rs 7,115 crore, though the business continued to post losses of Rs 1,727 crore.

• Paytm, meanwhile, saw FY25 revenue decline sharply by 31% to Rs 6,900 crore (from Rs 9,977 crore), with net annual loss narrowing to Rs 663 crore on the back of cost-cutting, but still weighed down by a challenging regulatory and funding environment.

• Despite underwhelming top-line performance, Amazon remains committed to its India payments play. In 2025 alone, the parent company infused another Rs 950 crore into Amazon Pay India. Overall, Amazon has invested over Rs 12,000 crore ($1.4 billion) in the payments unit in India.• Recent acquisitions and product launches underline this strategic commitment: in September, Amazon completed the $200 million buyout of digital lender Axio (formerly Capital Float), strengthening its “buy-now, pay-later” (BNPL) and credit capabilities for nearly 10 million customers and merchants.

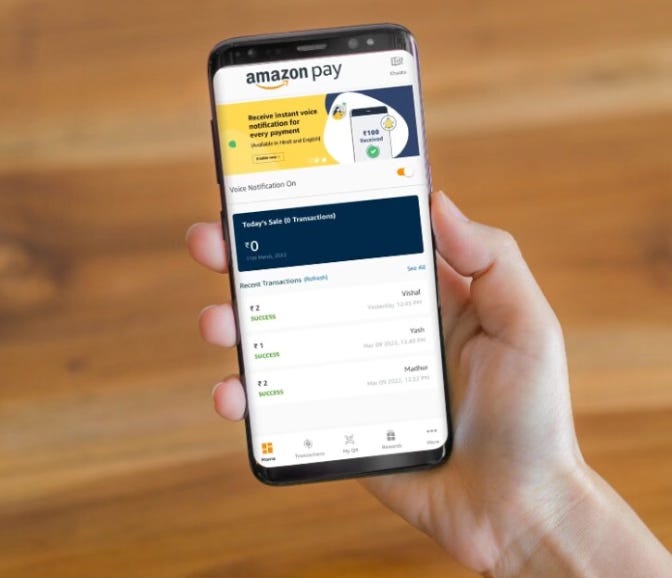

• Amazon Pay also received a payment aggregator license from RBI, expanded EMI and credit card-linked UPI services, and ramped up bill pay and insurance offerings-though it still ranks only eighth in market share within India’s UPI universe, with a user base exceeding 100 million.

• On the other hand, Amazon’s flagship e-commerce unit in India has been able to cut its net loss by over 90% and also increase revenues.