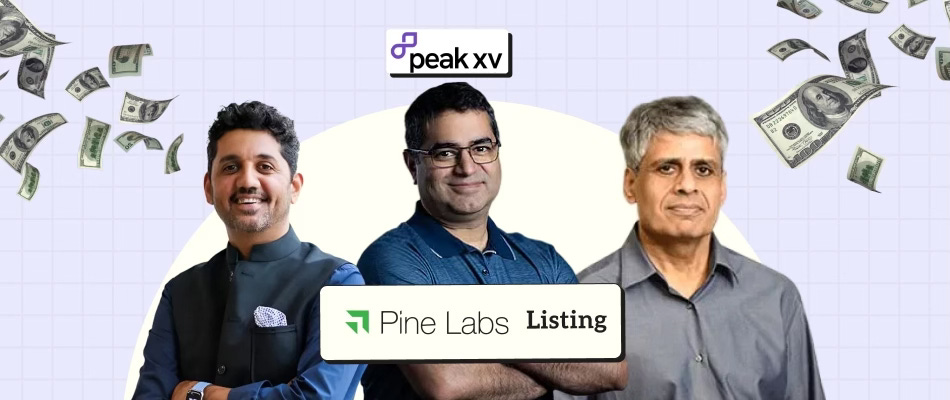

Peak XV’s Singh on 17-year Pine Labs bet: ‘We broke some rules on ownership’

Peak XV Partners emerged as the undisputed winner of the Pine Labs IPO, capitalising on a decade-plus thesis about Indian fintech digitisation. With initial checks inked in 2009 and a major institutional round in 2014, Peak XV’s cumulative $35 million outlay has, over the years, resulted in more than $1.1 billion in realised and unrealised value.

Pine Labs, one of India’s largest digital payments and merchant commerce platforms, was listed on Friday with its shares opening up 10% from the issue price and rising as much as 28% before closing at Rs 252, up by 14%.

Pine Labs had set a price band of Rs 210-221, which pegged the valuation at Rs 25,400 crore or over $2.9 billion. This was a 40% discount to the company’s last valuation of $5 billion in 2022.

At the close of trade on Friday, Pine Lab’s market capitalisation stood at Rs 28,936 crore ($3.2 billion). Pine Labs raised Rs 2,080 crore in fresh capital and an offer for sale of 82.3 million shares, coming to Rs 1,820 crore.

Selling shares via multiple rounds before the IPO, Peak XV took out about $575 million. At IPO, it offloaded another large chunk, 23 million shares worth Rs 508 crore ($61 million). Even after these exits, Peak XV retains a 17% stake worth approximately $556 million.

It is a jaw-dropping 39.5x return on the initial bet. This comes after the mega outcome from the Groww IPO earlier this week, where it sold shares worth $179 million, and its remaining shares are worth $1.7 billion.